2024 was an interesting year for the European heating pellet market, marked by improved demand growth alongside growing local supply. Likewise, pellet prices gradually returned to historical averages by the end of 2024 as Gilles Gauthier, Research and Business Development Manager at Hawkins Wright Ltd, a market intelligence and analytical services provider to the international pulp, paper and biomass industries, explains.

Demand for heating pellets in Europe showed a compound annual growth rate (CAGR) of +6 percent over the last 10 years. In 2024, demand grew by +4 percent, following two years of modest growth (+2 percent).

The 2024 increase was primarily supported by improved price competitiveness and a return to normal energy consumption by consumers.

Lower pellet prices meant the advantage over fossil fuels—particularly heating oil—improved significantly, peaking at a 46 percent price advantage for pellets over heating oil in Austria in April 2024.

This competitiveness led to increased use of pellet heating appliances, especially in buildings partially heated with fossil fuels, such as those using pellet stoves alongside fossil central heating systems.

The normalising global energy market also supported energy consumption for residential heating in Europe. During the energy crisis of 2022-23, consumers implemented energy saving measures.

Naturally, these measures tend to diminish as energy prices fall, leading to an increased use of pellet heating appliances.

Heating degree days not a driver

However, pellet demand across most of 2024 was not supported by cold weather. In fact, looking at the 2024 heating degree days (HDD) across several European countries such as Austria, France, Italy, Germany, and the UK, shows that 2024 was 4 percent to 9 percent milder compared to the average of the previous five years.

Sweden was the only country where HDD remained close to the historical average. This pattern aligns with the expected impact of the El Niño weather event, which generally results in warmer, wetter winters in Western and Southern Europe, though it can sometimes bring drier, colder winters to Northern Europe.

Roller coaster heating appliance sales

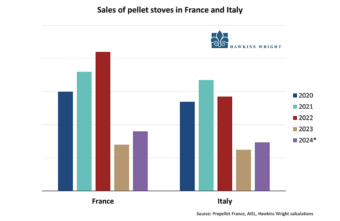

On the sale of heating appliances, although some data is still provisional, 2024 saw a modest recovery relative to the record-breaking sales of 2022.

Following the pellet market crisis of 2022, sales plummeted in 2023 and showed only a partial recovery in 2024, with variations across different markets.

For pellet stove sales, France and Italy remain the leading markets. In Italy, a mature pellet market, stove sales reached their highest levels prior to 2020.

Still, 2022 saw strong sales, which collapsed by -56 percent in 2023 and were followed by only a modest +18 percent recovery in 2024. Nonetheless, given the high maturity of the Italian market, new stove sales do not necessarily translate into increased pellet demand.

In contrast, France is a newer market where heating system sales more directly impact demand. French pellet stove sales hit a record high in 2022, before dropping -67 percent in 2023. Last year, sales recovered +29 percent, despite the -30 percent reduction in grants starting in April 2024.

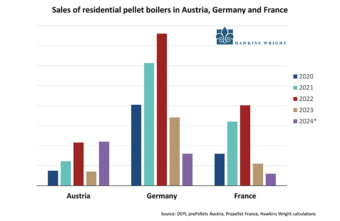

Germany and Austria have traditionally been strong markets for pellet boiler sales, while France saw significant growth up to 2022, when it was the second-largest market in Europe.

German boiler sales hit a record high in 2022, but fell by -55 percent and -53 percent in 2023 and in 2024, respectively. Austria saw an interesting trend, with a -68 percent decline in 2023, followed by a strong +214 percent recovery in 2024, bringing sales back to the record levels of 2022.

This resurgence was driven by a generous grant programme introduced in January 2024, but which was suspended in late 2024. In contrast, France saw two consecutive years of declining boiler sales, with drops of -73 percent in 2023 and -46 percent in 2024.

Poland also deserves mention. While reliable data on pellet boiler adoption and the subsequent demand remains scarce, several factors suggest an expanding heating pellet market in Poland for 2023 and 2024.

However, the outlook for heating pellet boilers in Poland remains uncertain, as the clean air programme was suspended on November 28, 2024, due to various issues. A revised version is scheduled for publication on March 31, 2025.

Rebalancing of pellet supply and demand

As a consequence of recent demand growth, the European heating pellet supply strongly increased, leading to a rebalancing of supply-demand. Strong sawmill profitability in late 2020 and most of 2021, combined with rising pellet demand, prompted significant investments in production capacity in many European countries.

Since building a pellet mill typically takes 1-2 years, these investments have accelerated heating pellet production capacity in the last few years. France, Austria, and Germany saw the largest expansions.

European retail pellet prices have steadily declined since the peak in Q4 2022, recently approaching the 10-year historical average in most markets. This decline is due to the rebalancing of supply and demand, combined with evenly distributed buying activity through 2024.

However, the bagged pellet markets have shown different trends compared to the bulk markets. The orders of bagged pellets have been below expectations at several points in 2024, partly due to consumers preferring to purchase smaller quantities.

In comparison, bulk pellet sales were more stable and sustained throughout the year, leading to largely flat prices until very recently in the case of Germany. In December 2024-January 2025, a strong increase of orders combined with limited immediate pellet availability, led to an uptick in pellet prices in Germany.

The overall price trend during 2024 was supported by declining pellet production costs until H2 2024, when feedstock prices started to trend upwards, forcing pellet suppliers to reduce their margin.

Looking ahead, weather conditions remain the biggest uncertainty, as they will significantly impact the remainder of the 2024-25 heating season. Heating appliance sales are likely to drive moderate demand growth, but the sales recovery is expected to remain slow.

Additionally, uncertainties surrounding Austria’s 2025 subsidy programme and further reductions in French support could negatively affect future sales.