Renewable energy capacity additions are exceeding fossil fuel generation investments by a widening margin and a record 162 GW of new renewable power was added in 2016 representing 60 percent of all new power capacity additions in that 12-month period. Underpinning these capacity additions were global investments in excess of US$260 billion in 2016, down from the record US$330 billion the previous year due in part to lower technology costs according to a newly released report.

Var vänlig ladda om sidan

Vill du läsa hela artikeln?

- Six editions per year

- Full access to all digital content

- The E-magazine Bioenergy international

- And more ...

The energy system is transforming and doing so rapidly. However, massive flows of finance are needed to accelerate renewable energy investments and more investment in renewables would reduce energy-related carbon emissions, a key element in efforts to limit global warming.

A new report, ‘Global Landscape of Renewable Energy Finance 2018’ jointly produced by the International Renewable Energy Agency (IRENA) and Climate Policy Initiative (CPI) outlines key global investment trends between 2013-2016, offering a comprehensive overview of capital flows by region and technology. The report also examines the differing roles and approaches of private and public finance, highlights the emergence of viable risk mitigation instruments, and provides an outlook for renewable energy finance in 2018 and beyond.

A key finding of the report is that to date, relatively low levels of capital are flowing from the world’s major institutional investors. In fact, institutional and private equity investors have contributed less than 1 percent each to global renewable energy investment in the last three years. Their investment peaked in 2015 at around US$3 billion and US$2 billion respectively.

One potential reason for their lack of commitment to low-carbon investments so far could perhaps be that the asset size is not significant enough to attract them yet. Once developers can present multi-billion dollar portfolios of operational projects institutional investors may be more inclined to engage.

Some of the key findings of the report include:

- Despite lower investment in 2016, versus 2015, from US$330 billion in 2015 to US$263 billion in 2016, 2016 saw record increases in installed renewable plant capacity.

- The falling cost of solar and wind was a significant driver of falling renewable energy investment – a positive for energy consumers.

- Solar PV and wind power dominate global spending on new renewables projects, moving from 83 percent of total finance in 2013, to 93 percent of total renewable energy investment in 2016.

- Offshore wind represented a steadily rising share of total wind investment. While all technologies including solar PV and onshore wind saw falling investment in 2016.

- Offshore wind investment increased fourfold since 2013 accounting for a US$25 billion, 25 percent share of total wind investment in 2016 and is poised for further growth

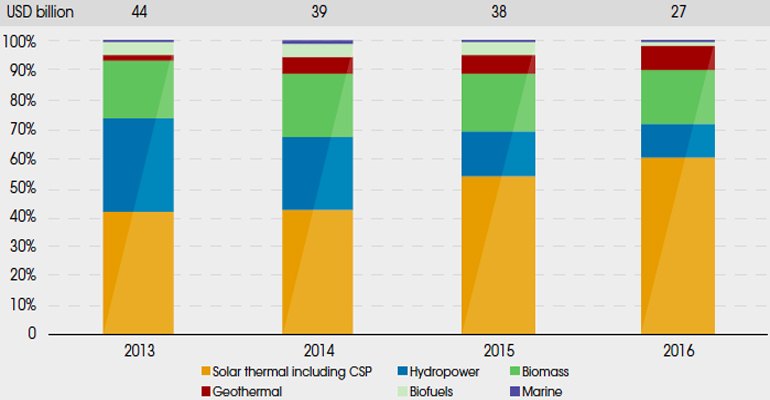

- Investment in biomass-fired power peaked at US$9 billion in 2014, slightly above the level in 2013, before trending downwards to US$5 billion in 2016.

- Investment in geothermal power was stable, averaging US$2 billion per year over 2013-2016.

- Investment in biofuels declined over the period, from an average of around US$1.7 billion annually during 2013-2016, to US$250 million in 2016.

- China commands more renewable energy investment than any other country and renewables investment in India has more than doubled between 2013-2016.

- Western Europe saw investment peak in 2015 at US$73 billion before falling to US$53 billion in 2016.

- Private sources provide the bulk of renewable energy investment globally – over 90 percent in 2016. Conventional debt and equity are the most prominent financing instruments.

- Public finance can play a key enabling role – covering early-stage project risk and getting new markets to maturity. Public spending on policy implementation far outweighs public investments.

- Project developers account for about two-fifths of private investment in the sector. Institutional investors – pension funds, insurance companies, sovereign wealth funds and others – only make up less than 5 percent of new investments.

- Private investors almost exclusively overwhelmingly favour domestic renewable energy projects, 93 percent of the private portfolio in 2013-2015, whereas public investment is more balanced between in-country and international financing.

- Investment levels are highly responsive to policy changes.